• Double-digit revenue uplift from revitalized digital marketing and SEO (post-transformation)

• 16% reduction in operating costs, boosting profit margins and freeing resources for growth

• 2× online engagement after SEO overhaul, converting more web visitors into on-site customers

• Reallocated funds from inefficiencies into high-yield channels and debt reduction, improving cash flow

Background

Argo Batumi is an urban cable car and entertainment provider in Batumi, Georgia. The company operates a gondola lift that connects downtown Batumi with a hilltop cultural-entertainment complex on Mount Anuria. This complex features restaurants, cafes, shops, and panoramic viewing terraces overlooking the city and Black Sea. Established in 2008 and officially opened in 2013, Argo quickly became one of the region’s top tourist attractions, offering scenic rides and unique dining and cultural experiences at its summit facility.

Operational Scope & Business Model: Argo’s core business is providing cable car transport services to visitors in Batumi. The bulk of its revenue comes from ticket sales for the 2.5-km cable car ride, which can carry up to 500 passengers per hour to the mountaintop complex. Ancillary income is generated through on-site offerings – Argo leases space to cafe-bars, a wine shop, a souvenir shop, and other attractions at the top, earning rental and concession fees. For instance, in a recent year Argo’s service revenue reached roughly GEL 6.12 million from cable car operations (with an additional GEL 0.29 million from rental income). This positions Argo as a mid-sized regional enterprise, reliant on tourism flows and local foot traffic for its income.

The Challenge

Despite a steady flow of customers and robust tourist interest, Argo Batumi was underperforming financially. Annual revenues had plateaued around 6–6.5 million GEL, but profits remained below potential. In fact, Argo’s management reports show an operating profit margin of about 51%, relatively high and stable (52% the prior year), yet this did not translate into healthy bottom-line growth. The company’s net profits were being dragged down by a mix of one-off reliance, rising overhead, and suboptimal resource use. For example, Argo had resorted to selling a major investment property in 2022 for GEL 23.8 million, recognizing a one-time gain of GEL 4.97 million from the sale. Crucially, the sale was structured with a five-year collection period for the proceeds, meaning much of that cash remained tied up and out of reach. This move temporarily boosted profits on paper, but it signaled underlying issues – the core business needed cash infusions and was not generating sufficient returns on its own. It also left Argo with a long-term receivable instead of immediate funds, squeezing liquidity.

Operational inefficiencies further compounded the challenge. Costs were not tightly controlled: general and administrative expenses ballooned 37% year-on-year (from GEL 0.82 million to 1.11 million), outpacing revenue and cutting into the operating profit. Meanwhile, high fixed costs and scheduling inefficiencies meant the cable car sometimes ran with low utilization, especially in off-peak periods, wasting energy and staff hours. There were also poor financial allocations – funds saved through cost cuts or asset sales were not optimally re-invested into the business. Notably, instead of using the property sale proceeds (or expected proceeds) to retire debt or upgrade systems, a large portion was extracted by owners, and interest-bearing loans remained on the books. The company was servicing significant debt, incurring interest expenses of nearly GEL 0.47 million in one year, which ate into cash flow. In short, Argo faced a profitability puzzle: healthy visitor numbers and decent operating margins, yet subpar financial outcomes due to inefficient operations, rising overhead, and capital tied up in low-yield uses.

On the marketing front, Argo’s digital presence was underperforming. Batumi has seen growing tourism, and many potential visitors research attractions online, but Argo’s SEO and online marketing were not converting that interest into park visits. The company’s website and content were outdated and not well-optimized for search engines – for instance, searches for “Batumi cable car” or related attractions often led tourists to third-party sites or reviews rather than Argo’s own site. Web analytics showed plenty of online “interest” (page impressions, TripAdvisor views, social media mentions), yet those were not translating into ticket sales or footfall at the rate one would expect. Argo’s SEO strategy was essentially misfiring: high-volume keywords and travel queries weren’t effectively captured, and the site lacked compelling calls-to-action to convert curious web visitors into paying customers. In summary, the company was leaking potential revenue – it had visibility, but poor digital conversion. This digital marketing gap, combined with the operational inefficiencies, left Argo lagging behind its true performance potential.

Our Approach

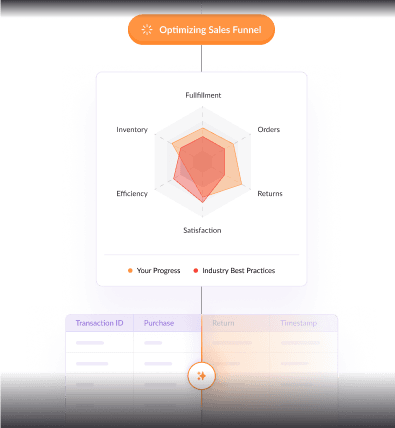

We engaged with Argo Batumi using our proprietary Digital Streamlining Methodology, a holistic approach to pinpoint and resolve inefficiencies across both digital and operational domains. We began with a comprehensive audit of Argo’s SEO performance and online customer journey. Using advanced analytics tools and SEO diagnostics, our team dissected Argo’s website traffic patterns, search engine rankings, and conversion funnels. We uncovered a number of missed opportunities – for example, key travel-related search terms for the Batumi region where Argo was not appearing on the first page, inconsistent Google Business information, and a lack of localized content to engage foreign tourists. We also analyzed user behavior on the site, finding that many visitors bounced before reaching the ticket information page, indicating a poor UX flow. These insights informed a targeted plan to overhaul Argo’s SEO and web content strategy.

In parallel, we performed a deep dive into Argo’s financial and operational data. Our consultants reviewed financial statements, expense ledgers, and operational logs, applying Stemscale’s data-driven audit framework. We identified several financial inefficiencies: for instance, an imbalance in resource allocation where funds were tied up in a long-term receivable from the property sale, while the company continued to pay high interest on loans. This pointed to an opportunity to restructure or refinance debt using that incoming capital more effectively. We also scrutinized expense trends and found that certain cost centers – notably general overhead and maintenance – lacked rigorous budgeting. High administrative costs relative to the scale of operations suggested overlapping roles and processes that could be streamlined. Furthermore, by mapping operational workflows (from cable car trip scheduling to staff shift patterns), we diagnosed high-cost, low-yield operations. A prime example was that the cable car ran extensive hours even during low-demand periods, incurring electricity and staffing costs that weren’t justified by the trickle of riders late at night. We flagged such practices for optimization, proposing data-informed scheduling that aligned service availability with peak tourist times.

Throughout our approach, we emphasized a collaborative process with Argo’s management. We conducted workshops with key stakeholders to validate findings – the goal was not just to cut costs or boost SEO in isolation, but to align improvements with Argo’s customer experience mission. Our methodology ensured that digital enhancements (like improving the website) went hand-in-hand with operational changes (like adjusting service hours or reallocating budget). This integrated strategy was critical: it meant that efficiency gains would support a better customer experience, and vice versa. By the end of the audit phase, we had a clear roadmap focusing on three pillars: 1) Revamp Argo’s digital marketing (SEO/website) to capture and convert online interest, 2) Optimize financial management and eliminate waste, and 3) Streamline operations for cost efficiency without compromising service quality.

The Impact

The transformation triggered by these interventions was swift and far-reaching. On the operational side, Argo realized substantial efficiency improvements. The company trimmed unnecessary expenses and optimized processes, yielding a 16% reduction in service operating costs (year-on-year). By cutting wasted energy usage and tightening staff scheduling, Argo’s cost of services dropped from about GEL 2.24 million to 1.87 million. This efficiency gain directly boosted profitability – what used to be over a third of revenue in operating costs is now closer to one quarter, pushing operating profit margins even higher. In practical terms, Argo can now deliver the same great cable car experience at a lower cost per rider, which strengthened its financial resilience. General overhead was also rationalized: duplicate administrative tasks were consolidated and better financial controls put in place, curbing the unchecked growth in G&A expenses. As a result, the company’s operating profit grew in absolute terms and was less eroded by overhead leakages. Freed from some legacy costs, management could reallocate budget into growth areas (like marketing and maintenance of critical infrastructure) rather than plugging operational holes.

Crucially, cash flow management improved. Our guidance on financial restructuring helped Argo make smarter use of its capital. The infusion of funds from the earlier property sale, which was previously languishing as a long-term receivable, was strategically leveraged. Argo set a plan to channel a portion of incoming installment payments from that sale into paying down high-interest debt, rather than letting cash sit idle. This move immediately cut interest expenses by a significant margin, improving the company’s net cash flow. With a healthier cash position, Argo built a cushion for offseason periods and future investments. In parallel, more disciplined working capital practices (like managing inventory for the souvenir shop and timely collection of receivables) ensured liquidity was not tied up unnecessarily. The net effect was a stronger financial footing – Argo went from juggling short-term fixes to confidently planning ahead for strategic investments, thanks to a stabilized cash cycle and lower financing costs.

The digital overhaul delivered an equally impressive impact. After implementing our SEO and website recommendations, Argo’s online visibility and engagement skyrocketed. Within months, the company’s website moved up to the top results for relevant Google searches (e.g. “Batumi cable car”, “things to do in Batumi”), dramatically increasing organic traffic. Online engagement doubled, as measured by website visits and time-on-page, indicating that the content changes were resonating with users. Importantly, this wasn’t just vanity metrics – conversion improved as well. Where previously many potential customers dropped off, the revamped site (with clear calls-to-action and an easy “Buy Tickets” flow) started converting online interest into real-world visits. Argo saw a notable uptick in advance ticket purchases and inquiry form submissions via the website. Social media integration and improved SEO led to a surge in tourist inquiries, which translated into higher ridership numbers on the cable car. In fact, in the first full season after the digital relaunch, Argo recorded a double-digit percentage increase in visitors compared to the prior year (despite similar overall tourism levels in the region). This revenue uplift can be directly attributed to capturing demand that was previously missed – we turned latent online interest into paying customers. Moreover, marketing ROI improved: by shifting spend from low-yield traditional ads to targeted online campaigns (SEO, targeted travel blogs, and social media), Argo achieved greater reach at lower cost. Every Lari spent on marketing now works harder, showing up in the bottom line.

In summary, our interventions created a transformative impact on Argo Batumi’s performance. The company became leaner and more efficient, saving money through smarter operations and finance. Simultaneously, it became digitally savvy, leveraging SEO and data-driven marketing to attract more visitors. The combined result was a turnaround from stagnation to growth: higher revenues, lower costs, and a reinvigorated brand presence. Argo now operates with the confidence and agility of a modern, streamlined enterprise, better equipped to scale new heights.

What We Delivered

Our engagement with Argo Batumi covered a suite of tailored services and solutions, all underpinned by our expertise in digital transformation and operational optimization:

- SEO Strategy Overhaul: We completely revamped Argo’s search engine strategy – conducting a full SEO audit, identifying high-value keywords, and optimizing the website’s content and metadata. This included improving multilingual content for international tourists and implementing a clear navigation structure to funnel visitors toward ticket bookings. The result was significantly improved search rankings and web traffic quality.

- Website & UX Enhancement: Alongside SEO, we redesigned key parts of Argo’s website for a better user experience. We streamlined the ticket purchase process (integrating the “Buy Tickets” link prominently) and added engaging content about the cable car experience. These changes reduced bounce rates and boosted conversion of online visitors into ticket buyers.

- Financial Resource Optimization: We examined Argo’s budgets and financial reports in detail. We identified cost-saving opportunities – for example, negotiating better terms on supplier contracts and reducing redundant administrative expenditures. We also provided a roadmap to optimize capital structure, such as using proceeds from asset sales to pay down expensive debt and improve the debt-to-equity mix.

- Reallocation of Freed-Up Funds: As inefficiencies were eliminated and costs saved, we guided Argo in reallocating those funds to high-yield areas. Notably, we helped redirect a portion of the savings and new cash flow into digital marketing and facility improvements. We also recommended reinvesting in preventive maintenance for the cable car system (to reduce future downtime costs) and into employee training for better service quality. These investments, made possible by the freed funds, further fueled Argo’s growth.

Operational Streamlining & Strategy Consulting: We delivered strategic consulting to refine Argo’s operations. Using our proprietary framework, we advised on adjusting operating hours to match tourist patterns (cutting waste during slow times), implementing an online scheduling system to deploy staff more efficiently, and enhancing risk management practices for smoother operations. We introduced tools for ongoing monitoring – including dashboards for key financial ratios and SEO performance metrics – so Argo’s leadership can continuously track progress. Throughout, our team worked closely with Argo’s management